S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 May, 2022

By Pam Rosacia, Madeleine Farman, and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Institutional investors are coming to the secondaries market to sell off sizable limited partnership stakes as they focus on liquidity and rebalance their portfolios.

California Public Employees' Retirement System is out in the market selling a $6 billion portfolio of fund interests, according to multiple reports. New York State Teachers' Retirement System sold a $2.6 billion portfolio in November of last year, according to Preqin.

LPs are motivated to sell as fund managers return to market quickly with new funds, often with larger initial targets than predecessor funds. Fifteen buyout fund managers each aim to raise at least $15 billion in 2022, according to Hamilton Lane, creating a "pressure cooker" environment for private equity fund managers and investors.

Additionally, recent declines in the value of public market holdings and strong returns for private equity assets have created an imbalance in some institutional portfolios.

"Usually, private equity lags quite a bit in terms of the private values coming back in line with the public values," said Nigel Dawn, senior managing director and head of Evercore's Private Capital Advisory Group. "That often takes several quarters to right itself, and there's a period of time where they'll be overallocated" to private equity.

Read more here.

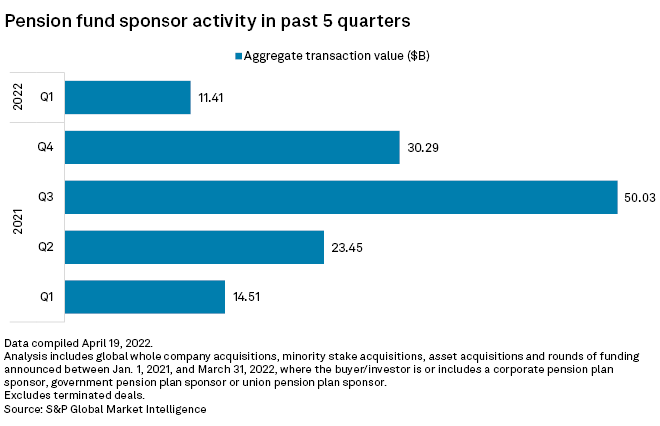

CHART OF THE WEEK: Pension fund deal-making slows in Q1

⮞ Pension fund sponsors took part in $11.41 billion worth of transactions in the first three months of 2022, a year-over-year decline of more than 21% for the period and the lowest quarterly total in at least a year.

⮞ Of the 25 disclosed deals involving a pension fund in the first quarter, 16 had private equity involvement.

⮞ The largest transaction was the $2.68 billion acquisition of Australian telecom provider Uniti Group Ltd. by an investor team that included Australian pension plan sponsor Nt-Comnwlth Super Corp.

FUNDRAISING AND DEALS

* Apollo Global Management Inc. and Roku Inc. are making a joint bid to acquire a minority interest in Starz, The Wall Street Journal reported, citing people familiar with the situation. Lions Gate Entertainment Corp., which bought Starz for $4.4 billion in 2016, is exploring a sale or spinoff of the pay TV and streaming service.

* Apollo wrapped up its purchase of Griffin Capital Co. LLC's U.S. asset management business.

* TPG Inc. is looking to raise $3.5 billion for its second healthcare fund, TPG Healthcare Partners II LP, WSJ reported, citing people familiar with the matter. The private equity firm reportedly is targeting a combined total of $18.5 billion for both the new healthcare fund and for TPG Partners IX LP.

* Advent International Corp. agreed to purchase a significant stake in food service packaging and janitorial supplies company Imperial Dade from Bain Capital Pvt. Equity LP.

ELSEWHERE IN THE INDUSTRY

* StepStone Group Inc. brought in $1.3 billion for StepStone Senior Corporate Lending II, which will invest in post-pandemic vintage, senior secured, first-lien performing corporate loans.

* Stonepeak Partners LP will acquire a minority stake in private school operator Inspired Education Group in a deal valued at €1.0 billion.

* RoundTable Healthcare Partners secured $800 million for Roundtable Healthcare Partners VI LP, which will continue the private equity firm's strategy of investing in healthcare businesses.

* Lonsdale Capital Partners LLP added U.K.-based dental practice operator Todays Dental Group Ltd. to its portfolio.

FOCUS ON: FINANCIAL SERVICES

* TowerBrook Capital Partners LP will acquire U.K.-based installment finance services provider Premium Credit Ltd. from Cinven Ltd. in a transaction that could close in the second half of 2022.

* WestCap Management LLC led a series C funding round that pulled in $115 million for home equity platform Point Digital Finance Inc.

* Aquiline Capital Partners LLC pulled in $365 million for Aquiline Technology Growth Fund II LP, which invests in financial technology, insurtech and related enterprise software and services.